Springsteen Fans Raged Over Ticket Prices. Experts Say There’s No Easy Fix

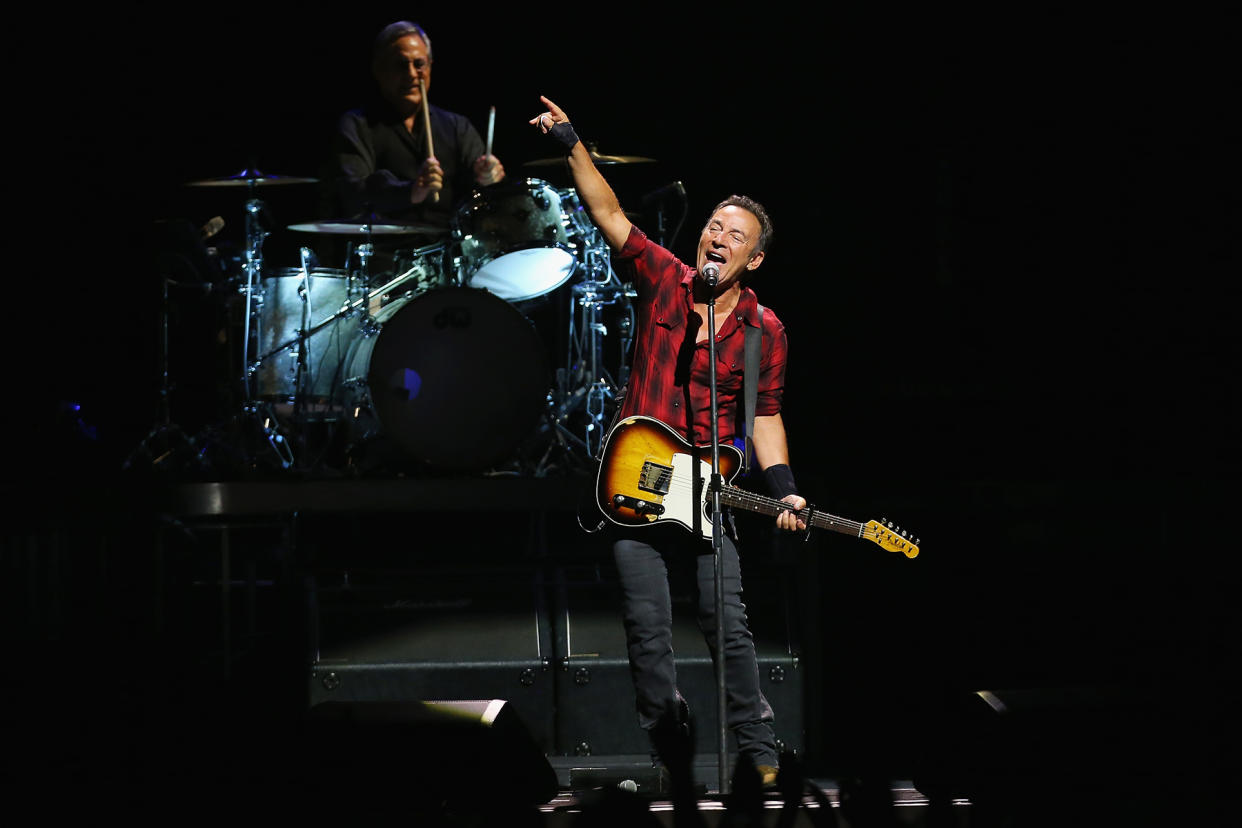

For the past four decades, Backstreets Magazine has devoted itself entirely to the world of Bruce Springsteen. Longtime editor and superfan Christopher Phillips and his team treat every new album, archival release, and concert as joyous affairs. But on July 24, days after Springsteen’s long-awaited E Street Band tour went on sale and stunned fans who came across tickets costing upwards of $5,000, Phillips and company found themselves in the unusual position of writing a deeply critical editorial about their hero.

“This past week, too many Springsteen fans got thrown to the wolves, pushed aside in a way that seems as unfathomable as it was avoidable,” they wrote. “The artist has maintained that he understands the essential role of his audience. How, then, did we end up facing, in far too many instances, prices for tickets that exceeded normalcy, then departed from reality entirely by orders of magnitude?”

More from Rolling Stone

'She Schooled Us All': Inside Joni Mitchell's Stunning Return to Newport Folk Festival

Adele 'Finally' Announces Rescheduled Dates for Las Vegas Residency

The Springsteen fans were far from alone. Around the same time, Adele fans looking to buy tickets for her rescheduled Las Vegas residency on StubHub saw seats starting at $670 for nosebleeds and capping out at $40,000 for the front row. A quick glance at Ticketmaster reveals that “side view” seats for Lady Gaga at New Jersey’s MetLife Stadium are $445.80 (general admission front pit tickets are $923.40), and primo floor seats to Motley Crue/Def Leppard/Poison at PNC Park in Pittsburgh will set you back $987.50. Live Nation announced on recent earnings call that “fan demand for the best seats has driven concert ticket pricing up double digits from 2019, while entry level tickets average under $35.”

But eye-popping prices for high demand shows generated furious op-eds and social media posts in recent weeks (“So this is what a crisis of faith feels like,” Backstreets wrote in a widely-shared tweet), and caused many to conclude this was simply a matter of rock star greed.

The truth is far more complicated. For decades, the ticketing industry has formed into the current price-gouging headache it is, due to a combination of factors such as Live Nation’s near-monopoly over live music, artists’ growing reliance on touring for their revenue, new technology giving scalpers a larger platform to hike up prices, and limited government intervention to help control the market.

So this is what a crisis of faith feels like.

— Backstreets Magazine (@backstreetsmag) July 23, 2022

How Live Nation’s Near-Monopoly on the Concert Business Changed Live Music

In 1995, Pearl Jam grew so frustrated by Ticketmaster’s exorbitant service fees and stranglehold on the live music industry that they attempted to play only venues that used competing ticketing services. As they soon learned, this meant playing non-traditional venues like The Adams Field House at the University of Montana. When they went back out in 1998, they simply gave up and played largely Ticketmaster venues.

It’s been over 25 years since Pearl Jam found out that touring on a large scale without Ticketmaster is basically impossible, and the situation has only grown worse. Companies like SeatGeek may have inked deals with major venues like the Barclays Center in Brooklyn, but Ticketmaster still controls over 80 percent of major concert venues in America.

“They are a monopoly,” says New York State Senator James Skoufis. “That comes with all of the standard problems that are associated with monopolies, not the least of which is there is not a healthy competitive market. They are able to charge whatever they want without any sort of consequence in what would otherwise be a competitive marketplace.”

“The ticketing industry is more competitive than ever,”a Ticketmaster spokesperson said to Rolling Stone, “and Ticketmaster invests millions in our technology every year to ensure we are able to help event organizers sell their tickets how they want to.”

“They are a monopoly. That comes with all of the standard problems that are associated with monopolies” – New York State Senator James Skoufis on Ticketmaster

Ticketmaster’s 2010 merger with Live Nation made the two companies exponentially more powerful. In 2021, Live Nation sold over 13 million tickets and grossed over a billion dollars. AEG, its chief competitor, sold 3 million tickets and grossed $281 million. Simply put, Live Nation would be the hegemonic power in the live event space even without Ticketmaster. But once they merged, they became the mightiest force in the history of the live music industry.

With that power, fans have come to accept things like service fees that often jack up the total price by 30 percent, and on-sales for major events where resellers wind up with the lion’s share of the tickets. In recent years, as opposed to finding new and innovative ways to weed scalpers out of the system, Ticketmaster decided to profit from them by providing them with a way to effortlessly sell their tickets. (A Ticketmaster rep vehemently disputes this claim, writing that they have “invested tens of millions of dollars and considerable resources developing technologies that help real fans get fair access to tickets.” The company also claims that it doesn’t fully control ticketing fees, and that venues more often set and keep the ticket fee.)

Like most major ticketing companies, Ticketmaster has begun using “dynamic pricing” where ticket prices fluctuate, sometimes wildly, depending on demand. During the recent Springsteen on-sale, fans saw $400 tickets become $5,000 right in front of their eyes. “Promoters and artist representatives set pricing strategy and price range parameters on all tickets, including dynamic and fixed price points,” a spokesperson for Ticketmaster tells Rolling Stone. “Ticketmaster has created analytical tools that use historical and real-time data to help quantify supply and demand to determine prices. The promoters and artist representatives then determine the specific pricing for their shows.”

After a flood of outrage over high prices by Springsteen fans, Ticketmaster released numbers showing that only 12 percent of tickets to most shows used dynamic pricing, and the average ticket cost was $262. “While people may have had a very different impression,” a spokesperson for Ticketmaster tells Rolling Stone, “overall 18 percent of Springsteen’s U.S. tour tickets sold for under $99, and only 1 percent of tickets sold for more than $1,000.”

“If you underprice the tickets, you’re inviting brokers to get between you and fans and customers,” says one former industry executive

Springsteen’s manager Jon Landau echoed this sentiment in a statement to the New York Times last week. “In pricing tickets for this tour, we looked carefully at what our peers have been doing,” he said. “We chose prices that are lower than some and on par with others. “Regardless of the commentary about a modest number of tickets costing $1,000 or more, our true average ticket price has been in the mid-$200 range,” he continued. “I believe that in today’s environment, that is a fair price to see someone universally regarded as among the very greatest artists of his generation.” (Landau declined to comment for this story.)

But a lot of the cheaper tickets immediately wound up on resale sites like Stubhub or Ticketmaster’s own resale service. That left many fans forced to pick between inflated tickets on the secondary market or face value seats that typically cost $1,000 each.

For many fans, buying tickets to concerts has become a confusing, highly stressful event, where they wind up spending way more than they’d like, and there’s little sign that’ll change anytime soon.

Addressing Low Supply of Tickets that Allows Brokers to Thrive

Even without a dynamic pricing model, fans likely would’ve spent thousands for the most desirable tickets for Springsteen’s shows, but on the resale market instead of from Springsteen himself. Tickets are a fertile breeding ground for scalping because artists usually try to make tickets obtainable for fans, but the demand is too high for tickets to stay that way.

“What most people don’t recognize is that if you underprice the tickets, you’re inviting brokers to get between you and fans and customers,” a former industry executive says. “If you underprice anything, look at Sony — they underpriced their PS5s and a lot of interlopers stepped in and resold them at ridiculously high prices. It’s common sense: If you underprice something with overwhelming demand, someone is going to figure a way to get between you and your customer and make a profit off of that.”

In fact, the executive contends that the Springsteen prices likely could’ve sold for even more than they did. While such an assessment seems ludicrous — given the jaw-dropping prices on shows like Adele’s residency — it may not be off-base.

“I think you could’ve seen well north of $10,000 [per ticket]. You could’ve tripled the numbers. I think there was restraint; some careful consideration on how it looked for Bruce. It was a relatively conservative approach compared to what his peers do,” the exec says. “But it’s the first time he took a step like that and fans aren’t used to that from him. Clearly there was surprise. No fan ended up paying more than what they were willing to pay, and the same fans that bought the expensive tickets would’ve bought them on the resale market if not for this tactic.”

“Brokers are valuable to both the industry and ticket buyers as they hedge the risk for event organizers who are promoting low-demand events” – StubHub’s chief business officer Cris Miller

For decades, companies like StubHub and SeatGeek have harbored ticket scalpers who most consistently drive up ticket prices for the fans, and they’ve given them the best platform they’ve ever had to find a new buyer. No matter how much fans bemoan jacked-up prices, financially, the reselling sites have no incentive to dampen the market as they get a percentage of every purchase made on their sites.

“They’ve done a masterful job in painting themselves on being on the side of the fan, but what they’ve really done is create this economy that in a sense has allowed brokers to get in the middle,” the ticketing exec says of the resale markets.

In a statement to Rolling Stone, StubHub’s chief business officer Cris Miller refuted the criticism and added that brokers play a key role in the ticketing landscape by helping mitigate risk promoters take on for concerts.

“StubHub’s seller base is split evenly between brokers and independent sellers, made up of everyday ticket buyers who are re-listing tickets they’re unable to use,” Miller says. “Brokers are valuable to both the industry and ticket buyers as they hedge the risk for event organizers who are promoting low-demand events and they increase accessibility for fans by offering healthy competition and multiple points of distribution.”

Miller claims that reselling is an important tool for fans in a primary ticketing environment that “is not currently predicated on access nor ease for fans. First and foremost, the industry is lacking transparency, which results in uninformed fans who are not empowered to make educated buying decisions,” he says. “Coupled with single channels for distribution – reducing healthy competition in the interest of buyers – fans are left with no options but to jump through hoops to try to buy tickets to an event from an unknown amount of inventory.”

Regarding the potential to cap how much a reseller can earn on tickets, Miller maintains support for allowing resellers to charge what they want without limit. “We believe artists have a right to be able to sell their tickets at whatever price they see fit,” Miller says. “And similarly, once that ticket is rightfully purchased by a consumer, we respect that ticketholder’s right and freedom to resell their ticket, freely as a truly free market should allow.”

“I could imagine a scenario where an artist parked in a city … They just have to sit somewhere and be willing to satisfy all the demand” – Lyte’s Chief Strategy Officer Lawrence Peryer

The scalpers themselves still have a leg up on fans because of bots that can help them grab more tickets, and with other strategies like farming phone numbers to get more chances to land tickets that require personal information. The only way to calm down the scalping market is to address the low supply for the sky-high demand for shows. That could either be through government intervention or initiatives from artists.

There are also ticketing startups who want to find solutions themselves. Lyte, founded in 2014 by Ant Taylor, aims to give fans more power in the resale market by creating a market where they can exchange and return tickets. Lyte also works with promoters and agents by asking fans to “pre-order” tickets to shows by getting their credit card information to confirm they want to buy a ticket in advance.

While an artist is routing their tour, they can use the information from Lyte to determine what size room they need and more specifically calculate demand. Such a strategy may not make much of a difference for the Billie Eilishes of the industry, who confidently know they’ll likely sell out whatever size venue they play, but Lyte’s Chief Strategy Officer Lawrence Peryer is confident the concept is effective.

“A lot of other ticketing solutions focus on only the supply. So people go in time-exclusive ticketing deals for the rights to control a venue for a period of time or a tour for a period of time,” Peryer says. “And we really look at both sides of the market. We look at the supply and the demand. We try to capture as much demand before and after an on-sale and before and after sell out, so that the promoter or whoever is planning the event or the tour has insight into the demand. And then they can make decisions.”

Matias Delacroix/NurPhoto/Getty Images

Artists Can Try and Take More Control of Their Ticketing Strategies

While corporations exert a significant amount of control over the market, the buck — to a certain extent — stops with an artist and their teams as far as decisions about ticket prices, the number of dates they’ll play and where they’ll perform. While Live Nation and Ticketmaster will more than likely urge high-demand artists to use tools like dynamic pricing to take more of the profits off the scalpers and put them into the artist’s hands and their own, the artist has to agree to whatever ticketing strategy their tour employs.

Some of the more-common tools are Ticketmaster’s Verified Fan technology, which in theory should help ensure fans who won’t resell tickets get the first shot to buy. And there’s non-transferrable tickets, which should ostensibly remove scalpers from the marketplace and ensure tickets will maintain a fixed rate.

And if an artist feels particularly passionate about ensuring tickets stay in fans’ hands and stay affordable, they have to take control of supply and demand. Garth Brooks, for example, notoriously floods a given market to drive up ticket supply to meet demand from fans.

“I could imagine a scenario where an artist parked in a city,” Peryer says. “They don’t have to play more shows, they don’t have to do anything differently in terms of how they currently function. They don’t have to work harder. They just have to sit somewhere and be willing to satisfy all the demand.”

“If you are working in this space as a policymaker and you aren’t already familiar with how much anger there is from fans, your head is in the sand,” says the former ticketing executive

But while an effort like Brooks’ is admirable, it’s extreme and unsustainable for most artists and unreasonable to expect an artist like Bruce Springsteen to play the amount of nights in one city it’d take before everyone who wanted to could see him.

There’s no one-size-fits-all solution for an artist to address ticketing problems, and it’s often an uphill battle for an artist to address ticketing themselves. Some states passed legislation that limits the tool artists can use for their tickets. Verified Fan helps slow down bots, but it’s unclear how much it actually stops scalpers. And non-transferable tickets aren’t always convenient either. The Black Keys, for example, used non-transferrable tickets for a special fanclub-only show at the Wiltern in Los Angeles in 2019.

Tickets couldn’t be resold for that show, but that didn’t stop scalpers from selling seats — which the band subsequently noted were $25 and intended for fan club members only — for hundreds of dollars on the secondary market anyways. Hundreds of fans were eventually turned away at the door the day of the show, and they sharply criticized the band for how the event was handled despite efforts that were initially enacted to try and guarantee fans had the fairest shot at getting into an exclusive show.

But still, artists do have some autonomy for their ticketing strategies, and while they shouldn’t always be the first to blame for a ticketing fiasco, it is somewhat a matter of how aggressively they want to pursue a fair ticketing market for customers. As the former executive puts it, “Ticketmaster is mainly the order-taker here. If an artist said they wanted tickets to be five dollars, then that’s what they’d cost. Whether it’s Live Nation, Ticketmaster, AEG, everything should be in support of that. Then it’s a matter of the artists owning their decisions.

“Artists can say, ‘Look I’m worth it, you’re gonna pay that,’” the exec adds. “Take that to the consumers, then you let the fans decide if that’s right. Or on the other side, ‘I’m an altruist and I want fans to have the cheapest price possible, and I’ll still put on that show and leave some money.’ That’s great, and let the artists have those tools. The sad part is, I actually think a lot of those tools are there, they’re just not always being used.”

The Government Can Intervene

In theory, there’s much that the U.S. government could do to minimize the high price of tickets, or at least make the system fairer. They made a noble attempt in the final days of the Obama administration when the Better Online Tickets Sales Act passed, which outlawed the use of ticket bots. But there’s a big problem with the law nobody anticipated. “There has literally been zero enforcement,” says Skoufis. “Ticketmaster catches bot activity all the time. But they don’t send these instances to prosecutors.”

(A Ticketmaster representative claimed the company advocated for the BOTS Acts to include “private right of action” put in so ticketing companies could go after violators directly, but ultimately that wasn’t included in the law.)

Skoufis has attempted to pass a law that would compel Ticketmaster and other ticket services to alert the Attorney General’s office when bot activity is detected, and would even give them a piece of the fee that’s collected if successfully prosecuted, but it didn’t gain any traction in the State Assembly. “They went very hard against that on behalf of the ticketing platforms,” says Skoufis. “Across the board, they wanted nothing to do with this.”

(“Ticketmaster continues to work with state Attorneys General and the Federal Trade Commission in an effort to enforce the provisions of the BOTS Act,” Ticketmaster shared in a written statement to the FTC. “Ticketmaster has also pursued private lawsuits against bot users. Most recently, Ticketmaster invested substantial resources to litigate a case in federal court in the Central District of California, which resulted in a sweeping injunction against the defendant’s use of bots and similar tools.”)

Skoufis also tried to make it illegal for Ticketmaster and other companies to “double-dip” on a single ticket by charging a service fee for the original on-sale and then another one when it’s re-sold on their same platform. This was also shot down by the State Assembly even though it’s seemingly such a common sense measure that would be hard to reasonably oppose. “Everything I’m trying is a 99-1 issue out in the public,” Skoufis says. “Problem is the public doesn’t have an army of lobbyists. And the problem is the public doesn’t have access to the halls of power, in Albany or most other capitals.”

One thing Skoufis did manage to get signed into law was a requirement that companies list the full price of tickets upfront, instead of burying the service fees until the final moment of the transaction. “We were the first state in the nation to do this,” he says. “I do believe it will make a meaningful difference when folks are shopping around for a ticket they want to purchase. But also, at least around the edges, I think that in egregious situations, it may even shame the sellers into being more reasonable with their fees.”

“We worked collaboratively with New York policymakers to enact a new law that adds important new protections and transparency for fans, and we are supportive of industry-wide reforms to bring more clarity to ticket buyers,” a spokesperson for Ticketmaster told Rolling Stone, “and believe more can be done to aid artists in delivering their tickets to fans at price points they determine.”

And while Ticketmaster and Live Nation have more pull with lawmakers than your typical rock music fan — and it’s hard to imagine the day that the Ticketmaster/Live Nation monopoly will be broken apart by the government — Skoufis is optimistic that significant change may come in the future if consumers remain as livid as they are right now with the status quo. “If you are working in this space as a policymaker,” he says. “and you aren’t already familiar with how much anger there is from fans, your head is in the sand.”

Best of Rolling Stone