OneWater's (NASDAQ:ONEW) Q1 Earnings Results: Revenue In Line With Expectations, Stock Soars

Boat and marine products retailer OneWater Marine (NASDAQ:ONEW) reported results in line with analysts' expectations in Q1 FY2024, with revenue flat year on year at $364 million. It made a GAAP loss of $0.49 per share, down from its profit of $0.61 per share in the same quarter last year.

Is now the time to buy OneWater? Find out by accessing our full research report, it's free.

OneWater (ONEW) Q1 FY2024 Highlights:

Market Capitalization: $367 million

Revenue: $364 million vs analyst estimates of $364.5 million (small miss)

EPS: -$0.49 vs analyst estimates of -$0.32 (-$0.17 miss)

2024 guidance: exceeded expectations for same-store sales, slightly missed for EPS

Gross Margin (GAAP): 25.1%, down from 30% in the same quarter last year

Same-Store Sales were up 2% year on year (beat vs. expectations of up 0.8% year on year)

Store Locations: 98 at quarter end, decreasing by 2 over the last 12 months

“We delivered same store sales growth of 2% despite an increasingly competitive landscape with more moderated pricing. As expected, the return to traditional seasonal patterns and mix shift impacted results, with a preference towards our larger boat offerings during the historically slower winter months. While margins continue to stabilize, we are cautiously optimistic that we are nearing a new normal across the industry,” commented Austin Singleton, Chief Executive Officer at OneWater.

A public company since early 2020, OneWater Marine (NASDAQ:ONEW) sells boats, yachts, and other marine products.

Boat & Marine Retailer

Retailers that sell boats and marine products sell products, sure, but they also sell an image and lifestyle to an often wealthier customer. Unlike a car–which many use daily to get to/from work and to run personal and family errands–a boat or yacht is certainly a discretionary, luxury, nice-to-have purchase. While there is online competition, especially for research and discovery, the boat and yacht market is still very brick-and-mortar based given the magnitude of the purchase and the logistical costs associated with moving these products over long distances.

Sales Growth

OneWater is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

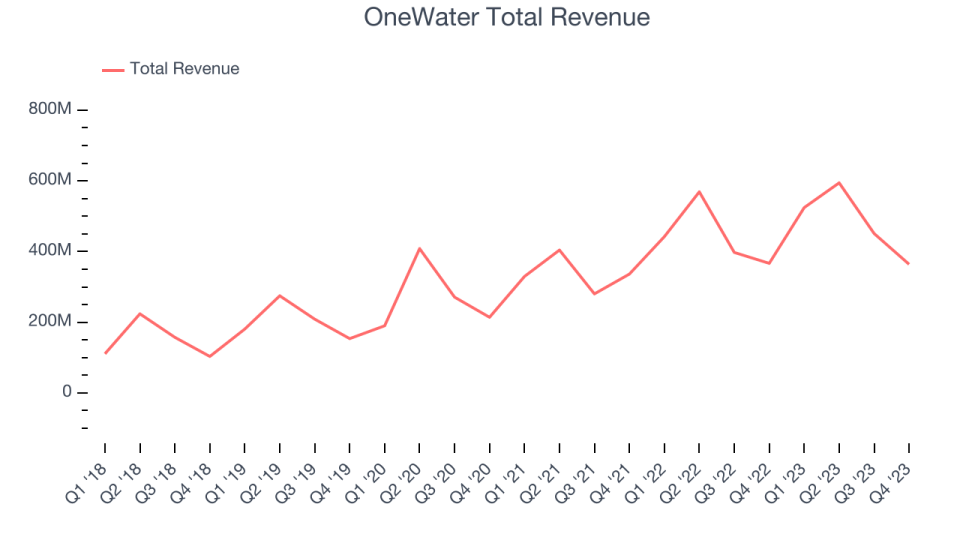

As you can see below, the company's annualized revenue growth rate of 24% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it added more brick-and-mortar locations and increased sales at existing, established stores.

This quarter, OneWater missed Wall Street's estimates and reported a rather uninspiring 0.7% year-on-year revenue decline, generating $364 million in revenue. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Number of Stores

A retailer's store count often determines on how much revenue it can generate.

When a retailer like OneWater is opening new stores, it usually means it's investing for growth because demand is greater than supply. OneWater's store count shrank by 2 locations, or 2%, over the last 12 months to 98 total retail locations in the most recently reported quarter.

Taking a step back, the company has rapidly opened new stores over the last eight quarters, averaging 19.3% annual growth in its physical footprint. This store growth is much higher than other retailers and gives OneWater a chance to scale towards a mid-sized company over time. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

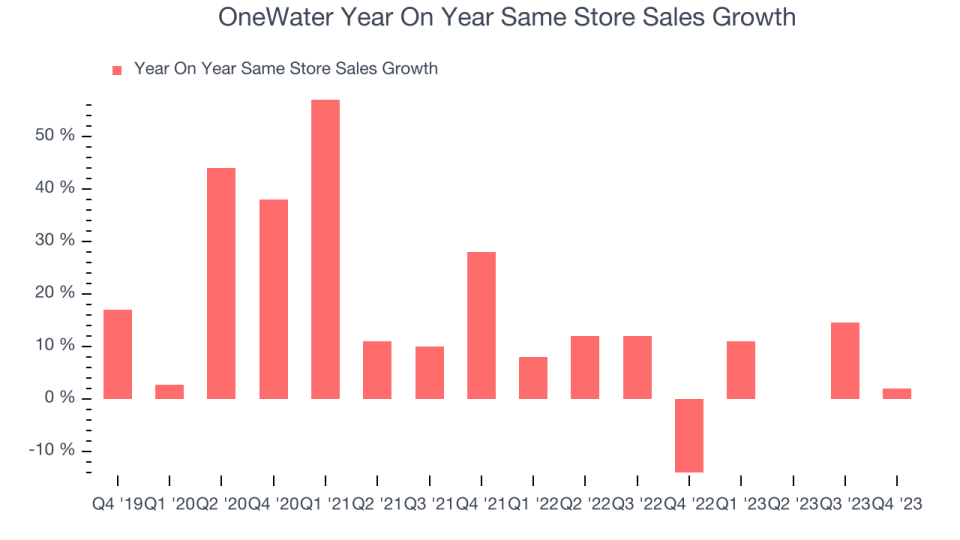

OneWater has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing stores. On average, the company has posted exceptional year-on-year same-store sales growth of 20,694,388,817%. This performance suggests that its rapid buildout of new stores is justified because when a company has strong demand, more locations should help it reach more customers seeking its products and boost revenue growth.

In the latest quarter, OneWater's same-store sales rose 2% year on year. By the company's standards, this growth was a meaningful deceleration from the 30,232,017,000% year-on-year increase it posted 12 months ago. We'll be watching OneWater closely to see if it can reaccelerate growth.

Key Takeaways from OneWater's Q1 Results

Same-stores sales beat in the quarter and guidance for full year same-store sales exceeded expectations. Full year EPS guidance was maintained, which is comforting. On the other hand, gross margin and EPS both missed analysts' expectations this quarter. Overall, the results were not perfect but pretty solid. The stock is up 7.4% after reporting and currently trades at $27 per share.

OneWater may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.