Taking the Pulse of the Pre-owned Watch Market

It’s no secret that the resale market is booming, yet one accessory in particular remains at the top of the most-wanted list: watches. Beyond the passing gray market, which is made up of unsold watch inventory, plus speculation on some iconic timepieces, there are the genuine vintage watches, specialist retailers, trades between avid collectors, countless forums, online marketplaces, etc.

In some aspects, the secondhand market has now become an alternate route for avid watch collectors who consider watches more than just an accessory — rather, they have shifted to be looked at as art and as an emotional investment. And while there are more people than ever interested in owning a high-end watch, luxury brands continue to produce limited quantities every year to ensure exclusivity and quality.

More from WWD

But scarcity isn’t the only factor driving the watch gold rush. Social media content and editorial content focusing on watches have become much broader factors that make it more approachable, including for younger generations, as luxury watch-related content generating more than 173 million views on TikTok alone.

Another key factor has been the surge in pricing controlled by dealers, which has caused watch brands to sit up and take notice, with several brands opting to reduce their number of authorized dealers and shift to a boutique model, allowing them to keep better track of their stock.

The secondhand luxury watch market is growing so fast that soon the market for new watches could begin to shrink, especially with the boom of a new breed of upscale pre-owned retailers such as WatchBox, WatchFinder and Chronext. Many continue to wonder how long it will be before the bubble bursts on the watch market.

Here, WWD speaks with several tastemakers and specialists on the current state of the pre-owned watch market.

Joshua Ganjei, chief executive officer, European Watch Company

WWD: Other than the big three (Rolex, Audemars Piguet, Patek Philippe), which watch brands hold their value in the second hand market and are top sellers?

Joshua Ganjei: Rolex, AP and Patek Philippe are definitely the gold standard when it comes to value retention, but there are a few other brands that also do well on the secondary market. F.P. Journe has been incredibly strong across the board and certain sport models from Vacheron Constantin, like the Overseas, have also been in high demand and have been selling for well-over MSRP.

WWD: What is the client profile of a person who buys on the secondhand market? How has the resale market opened the category to a new type of customer?

J.G.: It’s tough to boil it down to one single profile that captures all of our buyers. We see people from all walks of life, all ages, all backgrounds, all industries, the one thing they have in common is a passion for watches. The growth of the secondary market has really opened the hobby up to more people as you no longer need to have a relationship with an authorized dealer or brand boutique in order to find pieces and it’s easier than ever now to trade an old piece that might be sitting unused in a drawer for something newer and more exciting.

WWD: Other than the coastal U.S.A., what are some other big markets for secondhand watch sales? What do you attribute this to?

J.G.: This truly is a global hobby. We have clients all across the U.S., Europe, the Middle East and Asia, and everywhere in between. With the rise of internet sales, it doesn’t matter where you are. As long as you have a connection and a shipping address, you can find incredible pieces for sale and have them delivered right to your door.

WWD: How much of a bump does the announcement of newness at Watches and Wonders cause to the resale market? How does it shape the next six months of sales in the resale market?

J.G.: New watch announcements at Watches and Wonders or other trade shows or events don’t have much of an effect on the secondary market. More important is what is being discontinued. When a manufacturer announces that it is replacing a model with something new, the discontinued model almost always increases in value on the secondary market as it is no longer available for purchase from an AD [authorized dealer] or boutique.

WWD: Have there been any shifts on the customer side with people thinking about a watch as an investment piece? Are there some brands that are more collateral and some brands that are more emotional?

J.G.: We have definitely seen an increase in people viewing watches as investments. It’s very similar to what has happened with art or wine or vintage cars over the past 10 to 15 years. Whenever you have something that can potentially earn a large return, you’re bound to eventually see people start treating it more as an investment vehicle. Everyone is different and connects with different brands for different reasons, so it’s tough to say that one is more emotional than another, but Rolex has traditionally been considered to be “money in the bank” and is probably the brand that most people use for investment purposes.

WWD: With most secondhand retailers having dedicated online stores, will this new boom mean consumers will begin to turn their backs on traditional watch retail?

J.G.: I think that there will always be that buyer who only wants new and will never look on the secondary market, but more and more, the secondary market has become “traditional watch retail.” As the quality of merchandise on the secondary market continues to improve and online stores get better and better, there’s not much of a difference between the two.

WWD: Is pre-owned the future of the watch market?

J.G.: One hundred percent. Watches have really come back into the mainstream and demand far outpaces the ability of companies like Rolex, Patek Philippe and A. Lange & Sohne to produce enough merchandise to keep up. If you want a specific Rolex or Patek but can’t get it new, you can always find it on the secondary market from a reputable dealer. It also allows people to continually buy, sell and trade and to constantly evolve their collection as their tastes and interests change.

Alexandre Ghotbi, head of department, Continental Europe and Middle East, at Phillips Watches

WWD: Other than the big three, which watch brands hold their value in the secondhand market and are top sellers?

Alexandre Ghotbi: There are some brands that hold their value very well such as F.P. Journe but then there are specific models within a certain brand, such as early Lange, Cartier Crash or vintage Tank, Overseas from Vacheron Constantin to name just a few.

WWD: What is the client profile of a person who buys on the secondhand market? How has the resale market opened the category to a new type of customer?

A.G.: I don’t think there is a specific type. For a long time, the buyer of secondhand was someone who didn’t want to pay full retail, today someone buying on the secondary market is someone looking for a watch that cannot be found at retail due to long waiting lists or looking for a collectible piece no longer in production.

WWD: Other than the coastal U.S.A., what are some other big markets for secondhand watch sales? What do you attribute this to?

A.G.: The market for secondhand watches is truly international and not reserved to a specific area.

WWD: How much of a bump does the announcement of newness at Watches and Wonders cause to the resale market? How does it shape the next six months of sales in the resale market?

A.G.: For the hot brands, we see that as soon as a new watch is announced, the price on the secondary market goes up as soon as the first pieces hit the market.

WWD: Have there been any shifts on the customer side with people thinking about a watch as an investment piece? Are there some brands that are more collateral and some brands that are more emotional?

A.G.: I think that once people look at watches as investments, they automatically become collateral. I think, however, that collectors of vintage watches have a more emotional relationship with their watches.

WWD: With most secondhand retailers having dedicated online stores, will this new boom mean consumers will begin to turn their backs on traditional watch retail?

A.G.: Many brick-and-mortar shops also offer online sales. I think there will always be a place for traditional retail shops.

WWD: Is pre-owned the future of the watch market?

A.G.: Pre-owned depends on what new watches are launched and their desirability. I still think that the future of watches remains the primary market.

Maxim de Turckheim, senior buyer, luxury watches, at Mr Porter

WWD: Other than the big three, which watch brands hold their value in the secondhand market and are top sellers?

Maxim de Turckheim: Outside of Rolex, Patek Philippe and Audemars Piguet, we see customers gravitate toward known iconic brands Omega, Breguet and Hublot, which are definitely seen as long-term investments. Customers are buying into the most famous models such as “Speedmaster,” “Seamaster,” “Tradition” or “Big Bang.”

WWD: What is the client profile of a person who buys on the secondhand market? How has the resale market opened the category to a new type of customer?

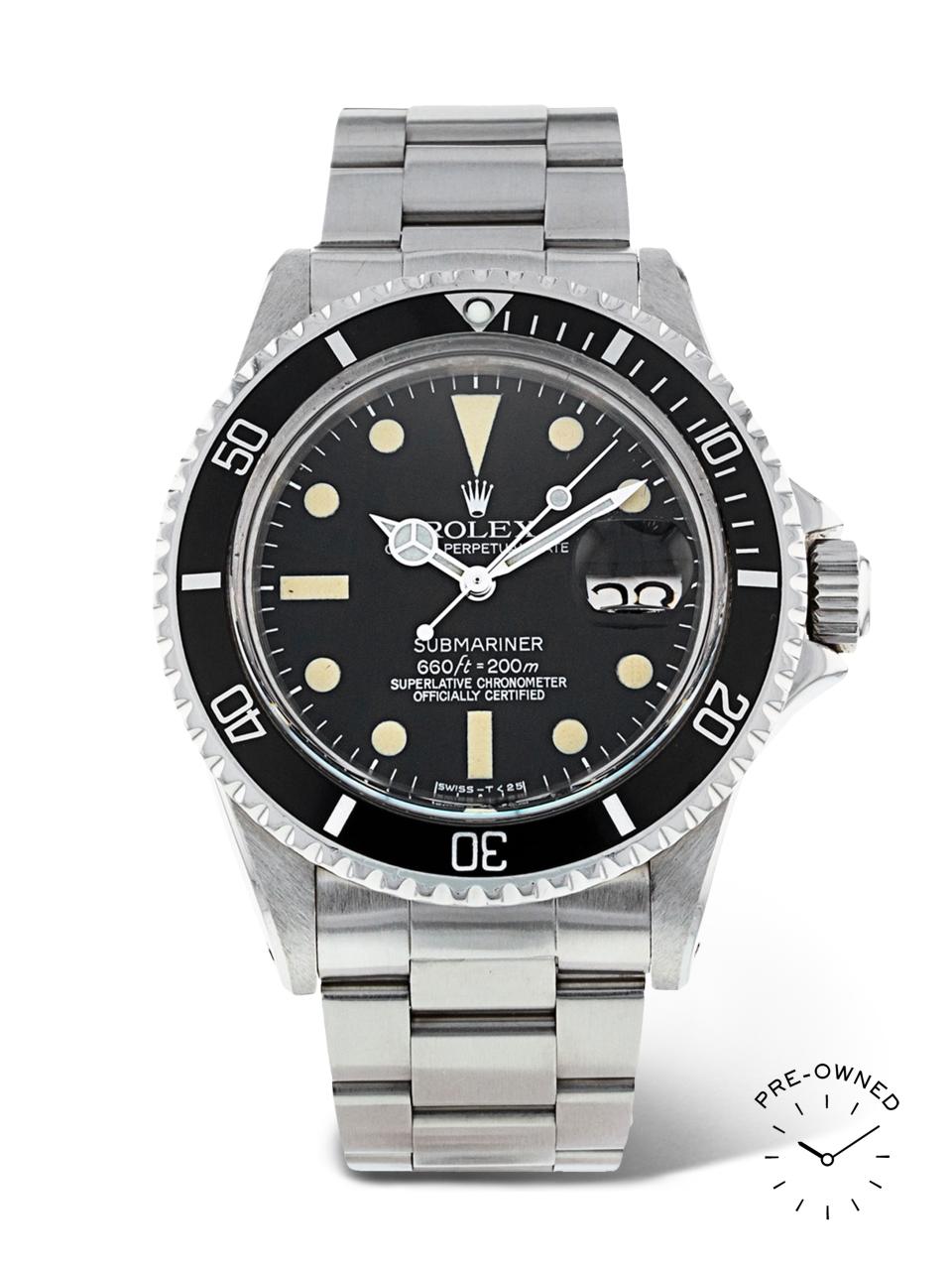

M.d.T.: We know that our customers come to us for investment pieces and quality items that last season after season. Across Mr Porter, we know that our customers value craftsmanship and longevity and a luxury watch, pre-owned or not, is no exception. With a new set of brands comes a new set of customers. Our pre-owned business attracts customers who may have searched elsewhere for a Patek Philippe Nautilus or a Rolex Submariner, but now come to us, because they know and trust that we will deliver them an authentic timepiece. For us at Mr Porter, the primary driver is trust. While we are a menswear platform, our customers come to us because they trust that we will offer them the world’s best product along with exceptional service.

Courtesy

WWD: Other than the coastal U.S.A., what are some other big markets for secondhand watch sales? What do you attribute this to?

M.d.T.: While we have seen healthy business from our coastal markets like New York, New Jersey, Massachusetts and California, we have also seen an uptick in the south in places like Florida and Texas, as well as Midwestern states like Illinois and Missouri, all with major metropolitan centers. We have also seen growth in pre-owned watch sales in markets with limited access to brick-and-mortar locations. We attribute this increase in sales to these states having less access to rare secondhand watch markets and therefore coming exclusively to Mr Porter to shop authenticated pieces.

WWD: How much of a bump does the announcement of newness at Watches and Wonders cause to the resale market? How does it shape the next six months of sales in the resale market?

M.d.T.: We launched our resell proposition in partnership with Watchfinder & Co. in July 2021. While the partnership has been successful, it’s too early to tell how newness at the Watches and Wonders will impact our pre-owned watch business. What we have seen, however, from the wider market is that when brands announce exciting new launches, this definitely has a trickle-down effect on their pre-owned market. For example, when Rolex will show the world its new launches this April, we expect this to impact our pre-owned stock onsite.

WWD: Have there been any shifts on the customer side with people thinking about a watch as an investment piece? Are there some brands that are more collateral and some brands that are more emotional?

M.d.T.: While some brands like Patek Philippe and Rolex have seen their costs appreciate significantly, they equally hold an emotional value. I think the value, whether financial or emotional, really depends on the owner. However, whether customers are buying new or pre-owned through Mr Porter they are definitely more aware of the resell value — which helps reassure them in their purchase. We also offer the opportunity for our customers to trade in their pieces in order to buy something new (a watch or something else) via our Part-Exchange Program so that definitely has helped them be more aware.

WWD: With most secondhand retailers having dedicated online stores, will this new boom mean consumers will begin to turn their backs on traditional watch retail?

M.d.T.: While I cannot speak to the future of brick-and-mortar, we have seen a steady increase of new customers coming to the site to shop both pre-owned watches and luxury watches. With the pandemic, we know that customers have become more and more comfortable shopping high price point investment items online and have even had some record high value sales during this period.

WWD: Is pre-owned the future of the overall watch market?

M.d.T.: Newness is naturally a huge part of the watch industry and something that is not likely to change. However, I do think that pre-owned will become increasingly relevant, as coveted watches and brands become increasingly rare. As we continue to see more and more customers prioritize sustainability and circular shopping habits, we will continue to see piqued interest in the pre-owned market. Therefore, I believe that secondhand pieces won’t ever entirely replace the new luxury watch segment but rather will continue to coexist in the larger watch category.

David Hurley, executive vice president, Watches of Switzerland Group U.S.

WWD: Other than the big three, which watch brands hold their value in the secondhand market and are top sellers?

David Hurley: In terms of contemporary pre-owned models, Cartier, A. Lange & S?hne and Vacheron Constantin are standouts from a secondary market standpoint, with recently produced models trading at or above original MSRP in many cases. We’ve also seen strong performance from micro-brands such as Unimatic, Kurono, Ming, and independents such as MB&F. Vintage pieces, of course, present an even more interesting set of data points.

WWD: What is the client profile of a person who buys on the secondhand market? How has the resale market opened the category to a new type of customer?

D.H.: Not terribly dissimilar from those who buy new from retail — in many cases, they are one and the same. The excitement behind vintage has had a trickle-down effect into the more traditional pre-owned marketplace, which has certainly had a persuasive effect on savvy enthusiasts to consider secondary market timepieces alongside new when building their collections. With trusted operations like Analog Shift, any aversion to pre-owned has quickly dissipated and the watch community has welcomed the secondary market as an integral part of the industry.

WWD: Other than the coastal U.S.A., what are some other big markets for secondhand watch sales? What do you attribute this to?

D.H.: We service clients throughout the U.S.A. and abroad — the demand for these pieces reaches across the globe, and while there are certainly pockets of higher saturation surrounding our store locations, our online presence knows no geographic boundaries. Platforms like Instagram and e-commerce have had an immense impact on our reach as well as the growth of the watch enthusiast community.

WWD: How much of a bump does the announcement of newness at Watches and Wonders cause to the resale market? How does it shape the next six months of sales in the resale market?

D.H.: New models released during the trade show season have had a profound effect on demand for secondary market timepieces in the past decade, and we see no signs of that changing. Every year, the Swiss manufactures renew their commitment vows to mechanical watchmaking, which causes further solidification in the market. Furthermore, new line extensions, colorways and models can have a pull-along effect for past models in terms of pricing and desirability — however, one might also consider what effect that demand and values for vintage pieces have on the new collections. There is a balance here, and both sides inform each other.

WWD: Have there been any shifts on the customer side with people thinking about a watch as an investment piece? Are there some brands that are more collateral and some brands that are more emotional?

D.H.: As the secondary value of luxury timepieces continues to rise, it is inevitable that collectors are asking intelligent questions regarding the sustainability of the market, and the truth of the matter is that there are certain brands or styles that are likely to drop out of favor on the investment side. With that said, the demand for mechanical timepieces has never been stronger, as evidenced with new and pre-owned alike, and in the case of vintage and pre-owned, we’re talking about watches that are often no longer being made. While trends for style, material or size will undoubtedly evolve, what we’re witnessing here is in many cases the start of new markets — and certainly some of these are built on pure emotion, for good reason!

WWD: With most secondhand retailers having dedicated online stores, will this new boom mean consumers will begin to turn their backs on traditional watch retail?

D.H.: Not at all — watch collecting is still very much a tactile hobby, and while the online presence has served to expand the marketplace dramatically, we are seeing an ever-increasing demand for our pre-owned products in traditional brick-and-mortar settings alongside our online channels. At Watches of Switzerland, we have worked to create an omnichannel experience across all our verticals.

WWD: Is pre-owned the future of the watch market?

D.H.: One might say they are the past…and very much a meaningful part of the future.

Danny Govberg, executive chairman and cofounder, WatchBox

WWD: Other than the big three, which watch brands hold value in the secondhand market and are top sellers?

Danny Govberg: The secondary watch market is stronger than ever, and we’ve witnessed a notable rise in demand and market value among independent brands and watchmakers. F.P. Journe, De Bethune and H. Moser & Cie. are three of our leading independent brands — each guided by a strong vision, creativity and a new way of looking at their craft. WatchBox specializes in highly unique and collectible timepieces, and we have witnessed a substantial increase in activity across the $20,000 to $100,000 spectrum. Many of our clients are experiencing an increase in confidence in purchasing higher priced timepieces, as there is greater recognition and strength across the secondary market.

WWD: What is the client profile of a person who buys on the secondhand market? How has the resale market opened the category to a new type of customer?

D.G.: Our customers are at the heart of everything we do, and WatchBox’s high-touch approach was architected around the way many collectors grow, modify and ultimately enjoy their watch collections. This extends from offering high-quality content and educational tools — as research often precedes buying decisions — to an active community, event culture and taking steps to eliminate friction throughout the buying and selling process. Interestingly, more than 35 percent of the watches we sell involve a trade, and we recognize that having a large, diversified inventory and readily accessible consultation with our advisers afford collectors the greatest opportunities to evolve their collections and not lose interest in this incredible hobby.

The current strength of the secondary watch market has given consumers the confidence to purchase and invest in both more expensive items, and incredible pieces by independent watchmakers and brands, knowing that there will be a market for them should they wish to trade or sell these watches in the future. WatchBox has focused increasingly on building these segments of our inventory, ensuring that we can deliver access to the world’s most collectible watches.

WWD: Other than the coastal U.S.A., what are other big markets for secondhand watch sales? What do you attribute this to?

D.G.: The strongest markets today for collectible watches outside of the U.S. include Hong Kong, Singapore, Switzerland, Dubai, London, Shanghai and Japan. When we started WatchBox in 2017, the concept of “pre-owned” was in a very different place than it is today. Historically, the pre-owned space was championed by parties not authorized by the brands, so similar to the genesis of the car industry and its embrace of the pre-owned category, we set out to redefine the modern pre-owned watch experience. Our mission was to bring authenticity, pricing transparency and confidence to this category, ultimately to elevate the global pre-owned experience and its perception. Today’s collectible watch ecosystem — and the rise of several top players in the space — have helped to proliferate and validate this message. We’re finding that the conversation is less about the “primary” or “secondary” markets today, and more about the overall global watch market.

WWD: How much of a bump does the announcement of newness at Watches and Wonders cause to the resale market? How does it shape the next six months of sales in the resale market?

D.G.: From a macro standpoint, the season of new introductions brings global attention to the watch category, opening what was once considered a niche hobby to a much broader audience. The market is getting bigger and bigger, yet there is a relatively fixed supply of new product coming into the market from the brands. The demand simply exceeds market supply, leading people who never previously considered purchasing a pre-owned timepiece to enter the category.

Excitement, hype, and speculation to future market value will certainly shape some of the market activity as collectors eagerly seek access to novelties; whether that is through a traditional retailer or once pieces begin to arrive across the secondary market.

WWD: Have there been any shifts on the customer side with people thinking about a watch as an investment piece? Are there some brands that are more collateral and some brands that are more emotional?

D.G.: Absolutely. And while the WatchBox model positions pre-owned watches as a tradable asset class with the benefits of real-time, market-driven pricing, we do not only look at timepieces as “financial investments” – this is a hobby of passion. Whenever there is an imbalance or shift between supply and demand, the opportunities to buy great product at great value will rise. Yet if the market shifts and financial conditions change, and you truly love the watches in your collection, you will be far less disappointed than if you only purchased watches based on hype and speculation.

WWD: With most secondhand retailers having dedicated online stores, will this new boom mean consumers will begin to turn their backs on traditional watch retail?

D.G.: We don’t foresee consumers turning their backs on traditional watch retail at the primary level. There will always be excitement in acquiring what’s new and hard to get; but what’s “new” is not obtainable for most consumers.

While our website represents an important segment of our business, the majority of our sales today actually take place over the phone. We use our website and digital marketing strategies to help drive leads, and then build relationships with our clients and support their collecting behaviors over the phone and in-person – plus through educational initiatives such as our library of thousands of hands-on video reviews. Since we founded WatchBox, establishing trust across our community has been of paramount importance. As we expand the WatchBox footprint, being physically closer to our community allows us to deliver the highest quality service and further relationships. Once a baseline of trust is established, we can support our community through whatever means of communication is most convenient to them.

WWD: Is pre-owned the future of the watch market?

D.G.: We have reached an exciting point in the evolution of the watch category where the conversation is less about the “primary” or “secondary” markets, and more about the overall global watch market and the state of collectible luxury watches. The luxury watch consumer has been educated to the availability of reliable trade-in services, opportunities to evolve their collections, and an expectation for trustworthy service. That being said, the state of the pre-owned market remains an important barometer – or mirror – for the health of a brand and the overall market.

Matthew Clarke, watch merchandising manager, The Real Real

WWD: Other than the big three, which watch brands hold their value in the secondhand market and are top sellers?

Matthew Clarke: It’s no surprise that Rolex, Audemars Piguet and Patek Philippe are smart brands to invest in, but there are a number of other brands that retain value really well and are at more of an entry-level price point. Omega has exhibited steady resale value growth over time, with exceptional models such as the Seamaster seeing among the highest average resale value of 83 percent. Likewise, stylistic brands like Bulgari and Cartier have seen resale values climb over the past year and have models — like the Ballon Blanc de Cartier (89 percent average resale value) and Bulgari Serpenti (68 percent average resale value) — that make excellent entry points for a budding collector to dip their toes into the watch investment world.

WWD: What is the client profile of a person who buys on the secondhand market? How has the resale market opened the category to a new type of customer?

M.C.: We have customers across every demographic, from Gen Z to the Silent Generation, with each group bringing their own trends and personal style into the mix. Our watch customers generally fall into two camps: the budding enthusiast who is just getting started in investing in watches and the serious collector who’s on the hunt for those rare, special pieces to expand their collection. The resale market has allowed for this sense of discovery and accessibility to happen from entry-level to auction-level pieces and that accessibility across the board has really taken the watch resale market to new heights.

WWD: Other than the coastal U.S.A., what are some other big markets for secondhand watch sales? What do you attribute this to?

M.C.: Chicago has consistently been a top watch market for us, driving nearly half of our high-value watch sales and maintaining an average sale price that’s 25 percent higher than our company average, while Austin, Texas, and Atlanta are our fastest-growing watch markets right now.

WWD: How much of a bump does the announcement of newness at Watches and Wonders cause to the resale market? How does it shape the next six months of sales in the resale market?

M.C.: We don’t see anywhere near the fluctuations in trends or demand within the secondary watch market the way we do with fashion. That’s part of what makes watches such a promising investment opportunity. Buzz from big moments at events like Watches and Wonders have a trickle-down effect into the secondary market, where it can drive increased overall demand for a brand or a style, like sports models or two-toned styles, but we don’t typically see a meaningful rise in demand for an individual watch.

WWD: Have there been any shifts on the customer side with people thinking about a watch as an investment piece? Are there some brands that are more collateral and some brands that are more emotional?

M.C : The secondary market has helped drive lasting value for watches through accessibility and reputation. Shoppers know they’re getting the real deal, and they have easy access to a wide variety of options. Luxury watches are a smart investment that hold value well, but are also functional — you can wear and enjoy them until you’re ready to sell. Classic models from timeless brands like Rolex and Audemars Piguet are the foundation of smart investment watch purchasing. The more emotional purchases often come from the higher end of the market. We’re seeing a behavior shift where shoppers are getting comfortable purchasing and selling auction-quality pieces online. These are those rare, statement pieces that a buyer forms a real connection with. Pieces like the Patek Philippe Nautilus 5712 we just sold for $150,000, and the vintage Patek Philippe 2526 we’ll be debuting at $480,000.

WWD: With most secondhand retailers having dedicated online stores, will this new boom mean consumers will begin to turn their backs on traditional watch retail?

M.C.: The secondary market has been a catalyst for expanding watch retail. Resale has made luxury watches more accessible — both in terms of price point and by bringing them online and giving buyers in every market the ability to shop. The primary market supply can’t serve that expanded audience, which is why resale is such a great complement.

WWD: How is the pre-owned the future of the overall watch market?

M.C.: As supply chain issues persist and prices continue to climb, the pre-owned watch market is offering something the primary market isn’t — accessibility for everyone. Resale offers the opportunity to join the world of watches by making entry-level pieces more affordable and giving equal access to exceptionally unique and rare models that have traditionally only been available through auction. The secondary market won’t replace traditional channels, but it is expanding the watch market and making it easier than ever for people to start and build their collections. It’s a journey that we’re excited to be a part of.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.